Seldom has the Fed faced such a challenge. The impact of tariffs will be pushing the economy away from achieving the Fed’s dual mandate—maximum employment and stable prices—at a time when the labor market has been near maximum employment and inflation has been running above the 2 percent target. Moreover, the Fed is getting intense and unrelenting pressure from elsewhere in Washington to lower its policy interest rate—the federal funds rate.

Economic principles argue for holding the policy interest rate unchanged when the economy is hit with a supply shock—such as a jump in tariff levels—if the central bank had considered the setting of that policy rate to have been appropriate for achieving the dual mandate prior to the shock. Such a supply shock causes prices to rise and output and employment to contract, tending to push the economy away from achieving both prongs of the dual mandate. A concern is that higher prices from the new tariffs will cause expectations of inflation by businesses and households to increase, adding to obstacles to achieving price stability.

Added to concerns about inflation expectations being affected by the tariffs are concerns about how inflation expectations may be affected by political efforts to lower rates prematurely. If the Fed were to lower rates prematurely, inflation pressures would build. History is rich with examples of countries with central banks that were not independent of the executive having higher and more volatile inflation resulting in greater challenges in lowering inflation. Should the public perceive that the Fed is succumbing to political pressure and easing policy prematurely, they will come to see more inflation down the road.

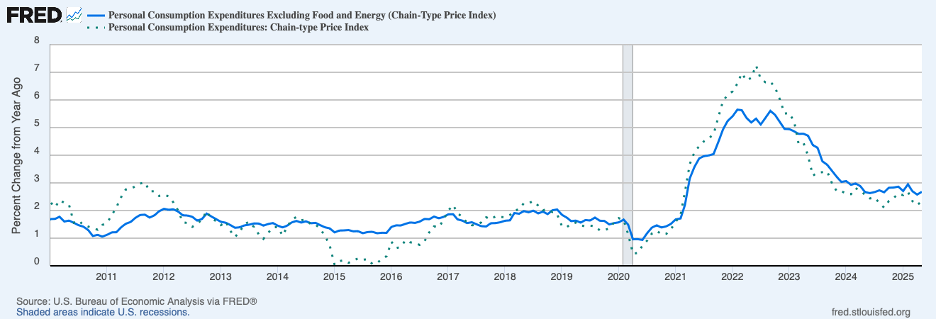

The recent news on inflation is presented below. Both headline and core PCE inflation ticked up in May as shown by twelve-month increases in PCE prices in the chart below (the dotted and solid line, respectively). Core inflation was 2.7 percent, the same as one year earlier and well above the Fed’s 2 percent target.

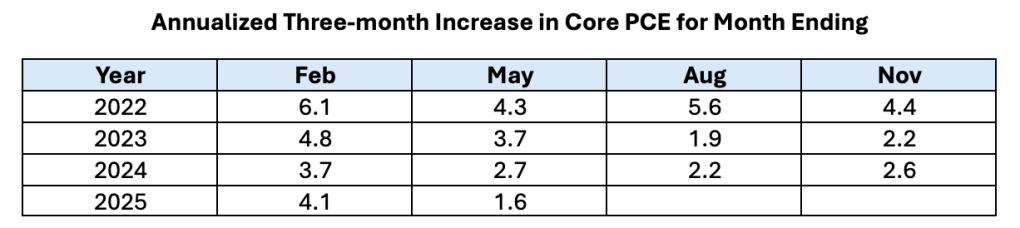

Looking at twelve-month increases can mask shifts in trend. The table below shows annualized three-month increases in core PCE prices through May. The recent evidence on whether the pace of core inflation has slowed in 2025 is somewhat mixed, as the increase in core PCE prices was below a year earlier in the most recent three months but was higher in the previous three months.

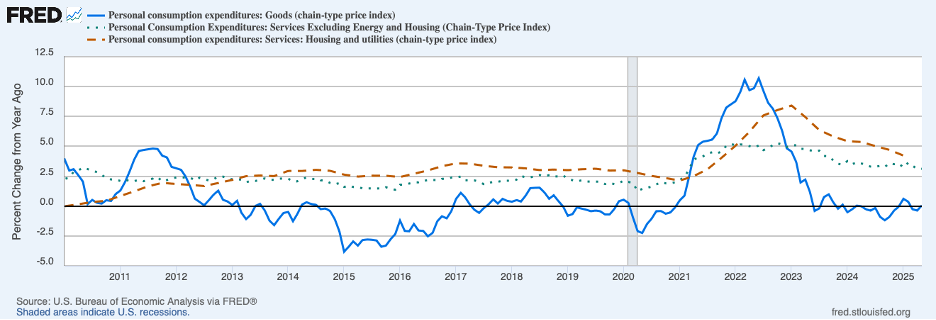

To better determine whether tariffs are having an impact on the PCE price index, the next chart decomposes twelve-month changes in PCE prices into goods prices (the solid blue line), housing (the broken red line), and service prices excluding housing (the dotted green line). Changes in goods prices, the category to be most affected by tariffs, have fluctuated around zero for more than a year. Goods prices ticked up in May and some other evidence suggests that tariffs may be beginning to have an impact on certain goods prices. However, the overall contribution of tariffs to PCE inflation to date appears to be quite small. The chart shows that housing inflation continues to be trending down, in part reflecting the abrupt drop in immigration, while service price inflation (excluding housing) was unchanged in May from April at 3.1 percent. Recent service price inflation has been about one percentage point above the pre-pandemic period. Thus, the PCE price data through May are indicating that underlying inflation continues to be stubbornly high, even apart from significant tariff effects.

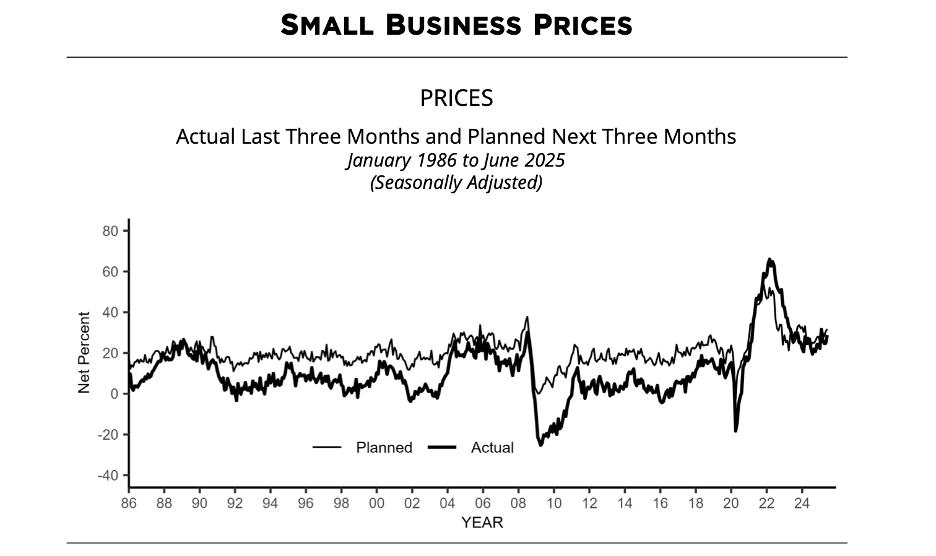

The most recent small business survey information from the National Federation of Independent Businesses (NFIB) is telling a similar story through June. The chart below shows the percent of small business respondents reporting actual price increases in the past three months (the thick line) and the percent planning to raise prices in the coming three months (the thin line). Both measures increased in June and continue to run above the pre-pandemic period.

The combination of stubbornly high inflation and intense pressure on the Fed to lower rates could be having an adverse effect on inflation expectations. If inflation expectation were on the upswing, more inflationary pressure would be developing. The chart below shows longer-term inflation expectations (the expected five-year inflation rate starting in five years) derived from the market for Treasury securities (nominal and inflation-protected Treasury notes). Although expectations are higher recently than on the eve of the tariff announcement in early April, longer-term inflation expectations remain in the range they have been in recent years (around 2-1/4 percent), suggesting that market participants have confidence that the Fed will hold the line. The Fed has earned this credibility through repeated statements that it intends to achieve price stability and by its complementary actions to subdue inflation starting in March 2022.

Going forward, to retain its credibility and demonstrate its independence, the Fed may need to err on the side of not bowing to the overt political force to lower rates until it is very clear to all parties that lower rates are required to achieve the maximum employment prong of the dual mandate.

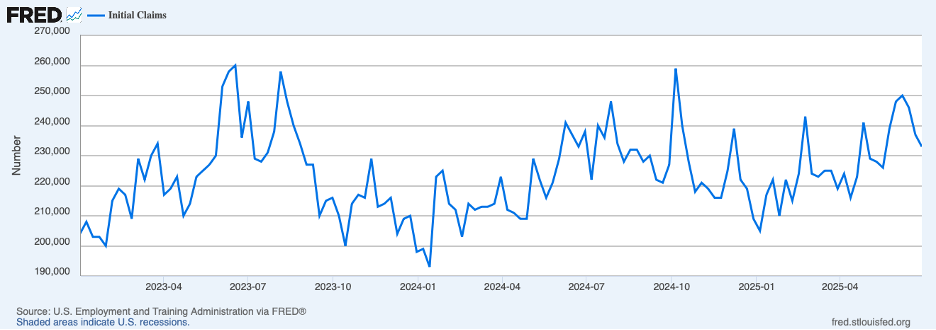

Turning to news on the labor market, recent data suggest that, while hiring is slowing, the labor market remains in good shape. Private-sector employment rose 74 thousand in June. Even though June employment growth was below the average monthly gain of 114 thousand over the first five months of the year, the June increase was broadly in line with the number of jobs required to absorb new entrants to the labor force and keep the unemployment rate unchanged. Moreover, initial claims for unemployment insurance through late June, the next chart, moved higher from very low levels earlier in the year, but have moderated most recently and do not point to much softening in the labor market.

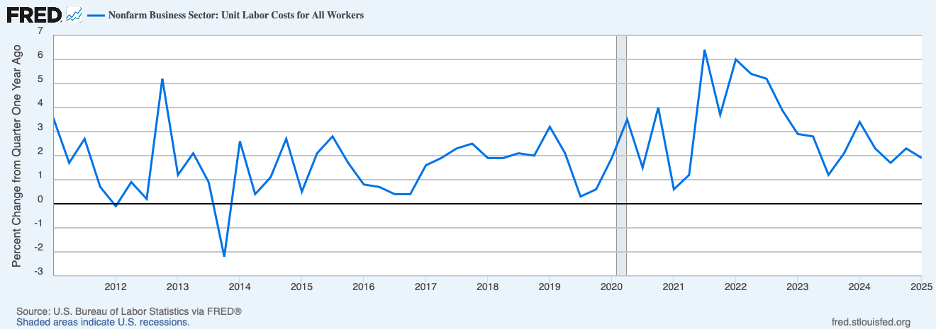

Helping to ease inflation forces in the period ahead will be continued sizable gains in productivity. Improvements in productivity hold down unit labor costs, enabling businesses to hold down price increases. The chart below shows that unit labor costs have increased at a subdued pace recently, in line with the pre-COVID period.

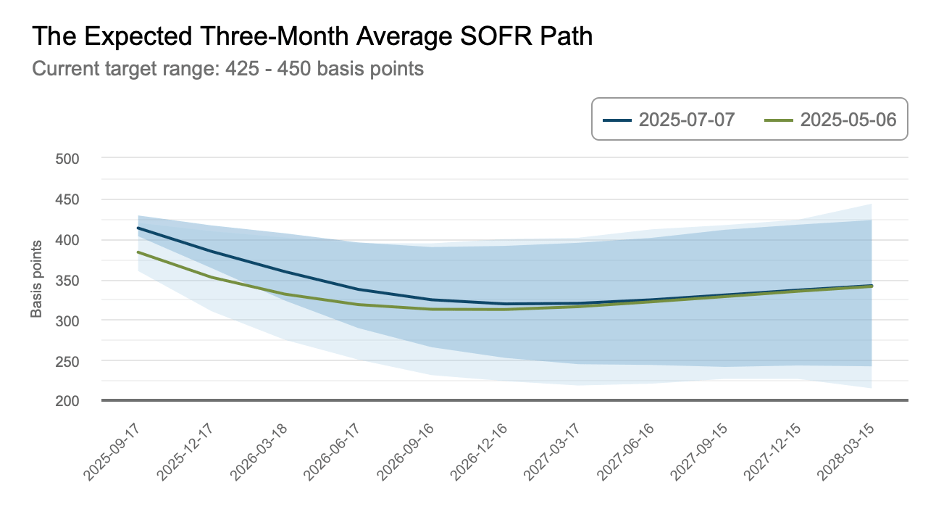

Expectations for the path of the federal funds rate show that market participants foresee less easing by the Fed currently than they did two months ago despite unrelenting criticism. Rate expectations are shown in the following chart depicting the expected path of the secured overnight financing rate (SOFR) which tracks closely the expected federal funds rate. Most recent expectations for the path (shown by the dark line) continue to see the Fed easing policy until early 2027. However, those recent rate expectations are about 50 basis points higher than in early May (the light line) through early 2026, suggesting that the Fed is expected withstand the political heat.

In sum, recent news on inflation indicates that inflation remains stubbornly above the Fed’s 2 percent target even as there are only traces of tariff effects through May. In addition, the labor market has deteriorated only marginally and remains in good condition. These circumstances would call for no change in Fed policy in the period ahead. Moreover, the tariff supply shock would reinforce a stand-pat Fed policy. Beyond these considerations, there is a serious risk that, if the Fed is seen as easing policy in response to intense political pressures, that the public will come to expect more inflation down the road which will boost increases in wages and prices. To demonstrate its independence and hold inflation expectations in check, the Fed may need to err on the side of restraint—not an enviable position.

Header Image: Jonathan Larson/Unsplash